Goldman blames mom-and-pop investors for volatility in stocks

Goldman blames mom-and-pop investors for volatility in stocks

The U.S. stock market has seen volatility rear up in 2018, with major indexes experiencing wild swings on a nearly daily basis. There have been a number of causes often cited for the recent bout of turbulence, including concerns over inflation, geopolitical uncertainty, and the first-quarter earnings season, but one of Wall Street’s most prominent investment banks fingers one key culprit: Main Street.

Citing both their outsize ownership of stocks and a surge in recent trading activity, Goldman attributed the recent whipsawing trading in the equity market to average investors, writing that retail investors—as opposed to institutional ones—“appear to have driven much of the U.S. equity market turbulence in late March and April.”

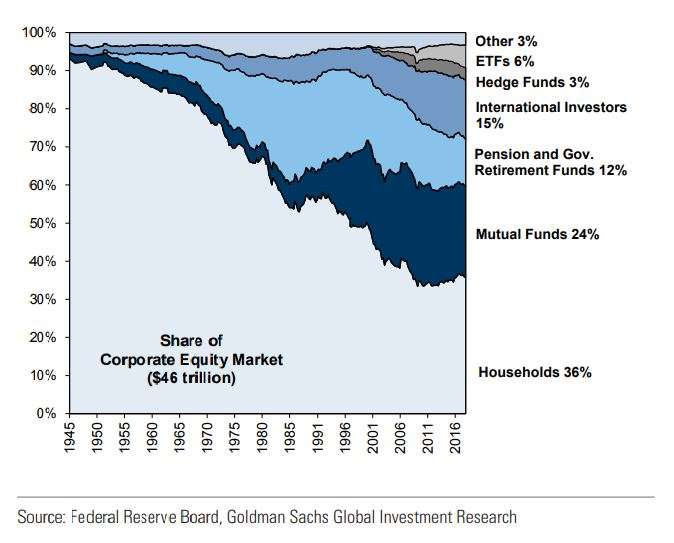

While retail investors individually control small amounts of money relative to portfolio managers or other professional market participants, their collective influence in the market is sizable. Per Goldman’s data, households directly own 36% of the $46 trillion U.S. equity market, more than any other type of owner, and their share rises to more than 50% if you include indirect ownership through mutual funds and exchange-traded funds. (Mutual funds own 24% of U.S. stocks, while ETFs own 6%.)

Related: Why ETFs can’t be blamed for the correction or volatility in stocks

© Provided by Dow Jones & Company, Inc.

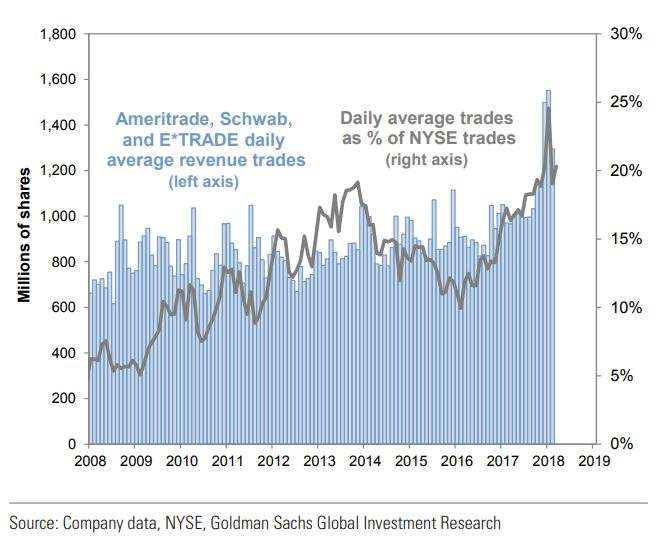

Retail activity in the market has also been rising, Goldman writes, which measured retail trading by calculating daily customer activity data from major retail brokerages like TD Ameritrade Holding Corp. (AMTD) Charles Schwab Corp. (SCHW) and E*Trade Financial Corp. (ETFC)

“Retail investors have long accounted for the bulk of U.S. equity ownership, but their share of trading has surged in early 2018,” according to Goldman, adding that “It leapt to the highest levels in at least a decade, both in absolute terms and scaled relative to total [New York Stock Exchange] trading activity.”

© Provided by Dow Jones & Company, Inc.

That surge in trading occurred at a time when composite trading volumes were otherwise low. March and April also marked “blackout” periods for many U.S. companies, meaning they halted their stock buyback programs in the lead-up to the reporting of their quarterly results, temporarily removing a primary source buyer for the broader market.

Those factors meant that retail trading had a bigger impact on overall trading, which contributed to the market’s volatility, in Goldman’s estimation.

Thus far this year, the Cboe Volatility Index (VIX), one closely tracked measure of volatility, is up 33.6%, although at 14.75 it remains below its long-term average. The gauge, which reflects bullish and bearish bets on the S&P 500 index for the coming 30 days, tends to climb as stocks fall. The Dow Jones Industrial Average is down 1.5% in 2018 while the S&P 500 is off 0.1% and the Nasdaq Composite Index is up 5.2%. Both the Dow and the S&P 500 are in correction territory, and have been for their longest stretch since the financial crisis

There were fundamental reasons for the market’s moves, even if they were exacerbated by factors like the corporate blackout period. In early February, the equity market dropped on concerns that inflation was returning to the economy. Further volatility was pegged to uncertainty over trade policy, among other factors that have whipsawed stocks even as benchmarks have maintained a tight trading range

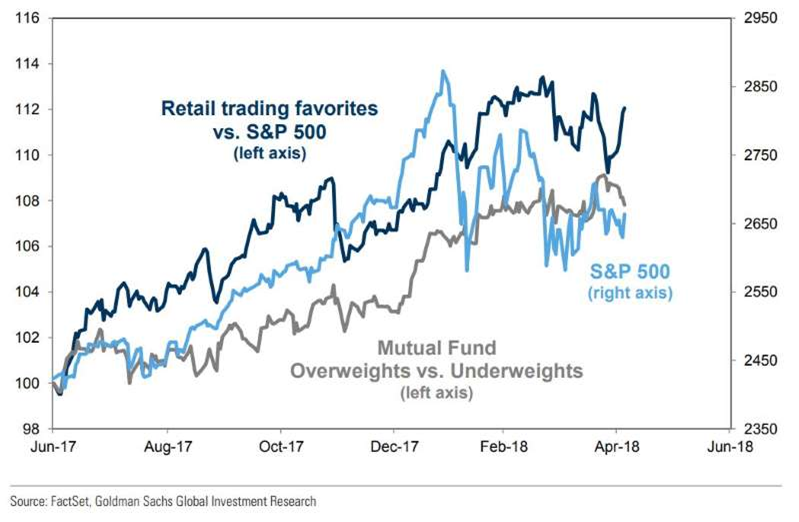

“Retail investors apparently reduced positions in their favorite stocks as well as broad equity market exposure; the popular stocks underperformed at the same time as U.S. equity mutual funds and ETFs experienced large-scale outflows,” Goldman wrote. “Trading favorites” is based on fund position filing and Google Trends data, the investment bank wrote; the list of such stocks includes Netflix (NFLX), Amazon (AMZN), Apple (AAPL), Nvidia (NVDA) and Activision Blizzard (ATVI), among others.

Don’t miss:Here’s why small-cap stocks could be vulnerable to ETF outflows

© Provided by Dow Jones & Company, Inc.

Source: